San Diego taxpayer sues over transparency in 101 Ash Street $250M proposal

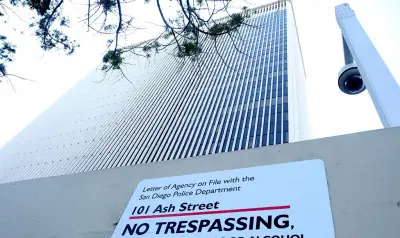

The blighted 101 Ash St. building in downtown San Diego has been a source of controversy for years. (Photo by Chris Stone/Times of San Diego) A public records lawsuit was filed Monday seeking documents from the city of San Diego related to the recent $250 million proposal to transform the blighted 101 Ash St. building into affordable housing units. The city’s Land Use and Housing Committee recently voted unanimously to recommend approving a deal to enter into a 60-year lease to convert the long-vacant property into nearly 250 residential units for families earning between 30% and 80% of the area’s median income. Copies of the ground lease and disposition and development agreement — which were not available at the time of the committee’s vote — are being sought in a new lawsuit filed on behalf of city resident John Gordon, who previously sued the city over its lease-to-own agreement for the 101 Ash St. property. “City officials are attempting to approve the 101 Ash Street (disposition and development agreement) and ground lease and related documents while concealing their essential terms from public scrutiny,” the complaint filed in San Diego Superior Court reads. Christina Bibler, director of the city’s Economic Development Department, has said those documents will be publicly available before the proposal goes before the San Diego City Council. At a Monday morning news conference held outside the vacant skyscraper, Gordon and one of his attorneys, former San Diego City Attorney Michael Aguirre, argued that many of the proposal’s particulars — such as how much it will cost to renovate the unoccupied, asbestos-riddled building — have been kept out of the public eye. Aguirre said another concern is that one of the companies selected to helm the project is headed by Kelly Moden, who sits on the city’s planning commission. “No city official should be entering into a contract with the city that’s going to give them an economic advantage,” Aguirre said. The deal proposes a loan equaling the building’s value — $45.6 million — and issuance of a seller’s note to recoup the money, plus 4% simple interest, over a 55-year period. The developers are also seeking millions in housing and historic tax credits, but Aguirre said the city has already missed a deadline for low-income housing tax credits, and he questioned whether historic tax credits can feasibly be acquired, as 101 Ash St. is not a historic property. “There’s real risk that we will have to pay for 101 Ash St. again and that’s via the $45 million in bonds,” Gordon said. “… This transaction really is a house of cards.”